Search for an answer or browse help topics

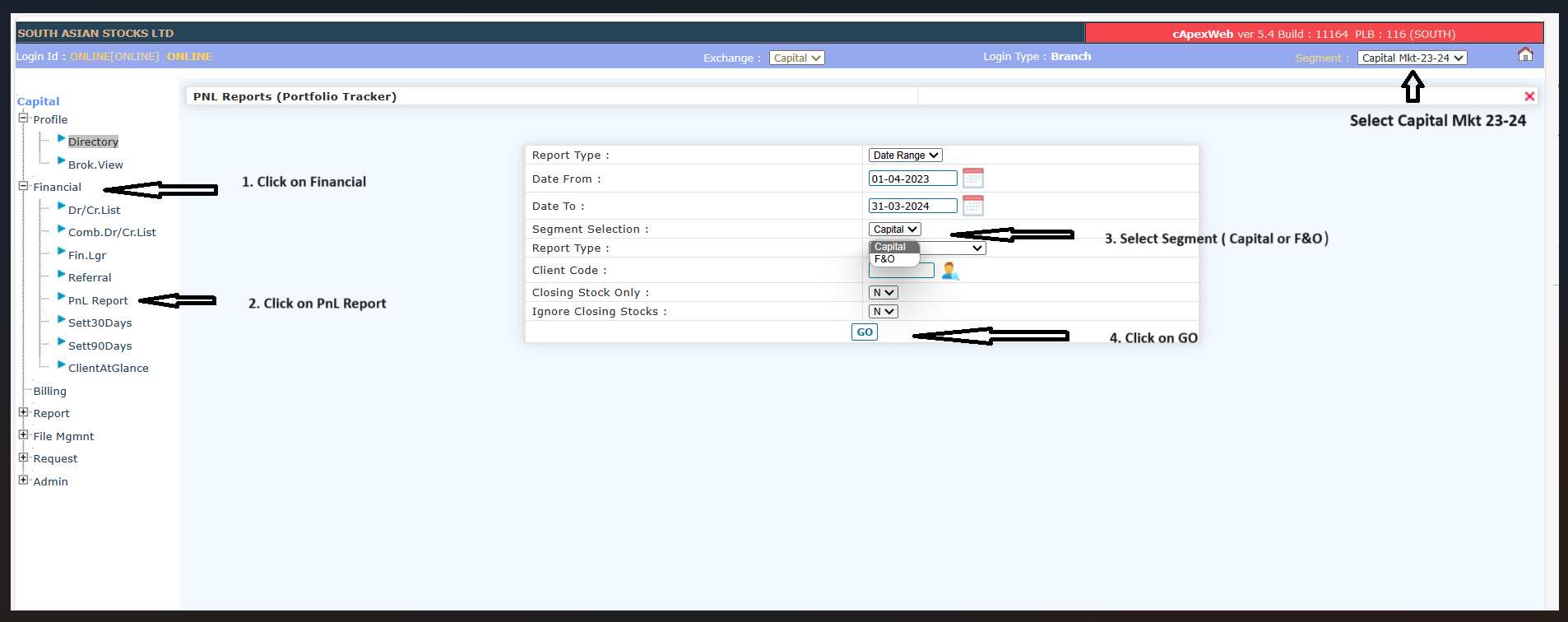

Kindly note that for tax filing, you can refer 'P&l Report after logging to the Back Office portal by selecting Capital Mkt: -23-24.

1. Select the current financial year and click on Financial >> P&L Report >> Select Capital + FNO >> GO

2. If you wish you can also download the report from the Upper Right-Hand side menu

.png)

** Please note for bonus shares date of allotment of bonus shares would be considered as date of acquisition and the cost of acquisition would be NIL . In case of split date of acquisition would be same as date of acquisition of original shares . Further cost of acquisition would be divided proportionately to the original and split shares.

Simply fill the details, connect your bank account & upload your documents.

Open An AccountYou will be redirected in a few seconds.