Search for an answer or browse help topics

Cover Order

A Cover Order is a market order or limit order that is placed along with a Stop Loss Order. In a Cover Order, the buy/sell order is a Market or Limit order that is accompanied with a compulsory Stop Loss order, in a specified range as pre-defined by the system, that cannot be canceled. As there is a compulsory Stop Loss Order the risk automatically reduces because of which the margin requirement also automatically reduces thereby giving more leverage to the client for intra-day trading.

Kindly note that all cover orders (CO) are squared off at 3:20 PM (Cash/Futures), 4:50 PM Currency (CDS), and 11:00 PM /11.30 PM (MCX).

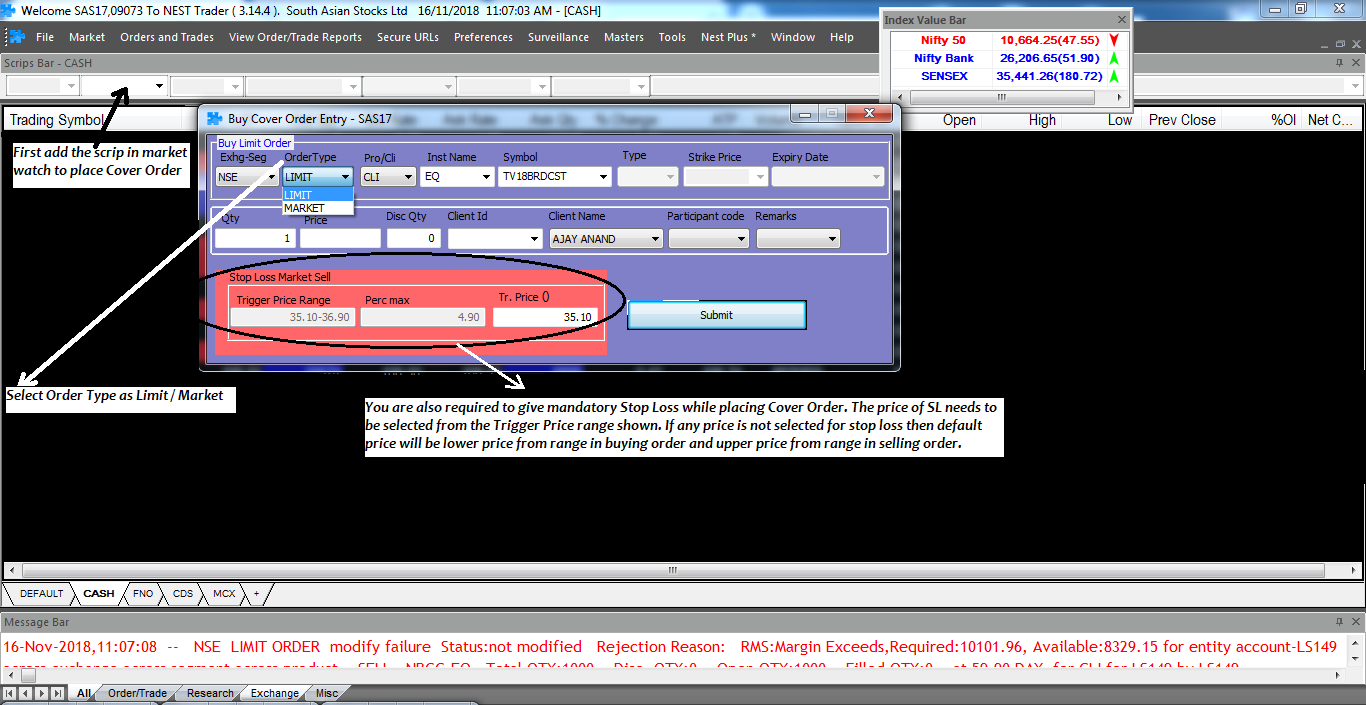

How To Place Cover Order:

For placing a cover order add the script in the market watch as shown below. For Buy cover order click (Shift+F1) & Sell Cover Order (Shift+F2). The Buy/Sell order will execute at the market price/limit price and stop-loss can be defined as per the defined stop loss range.

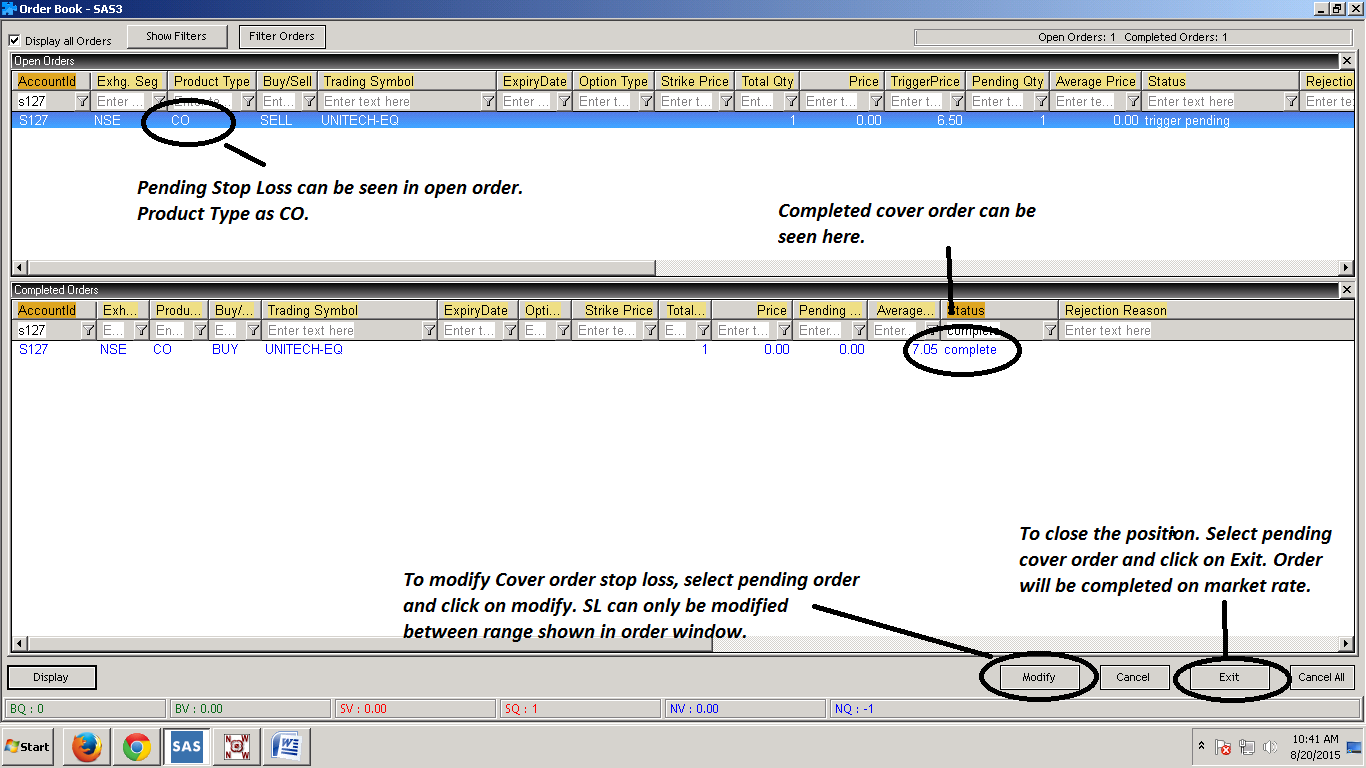

Once the CO order is placed completed market order or limit order and pending stop loss will be shown in the order book (F3). You can verify that it a cover order as the product type will be CO for the same. Stop Loss can be modified from the order book by using modify from the bottom of the window in the prescribed range only. Also note that against buying CO selling order should not be placed, as it will create a fresh position in your account and vice-versa.

Note: If you want to close the position at the current market click Exit from the bottom of the window. It will be executed completely as a partial position cannot be closed in CO.

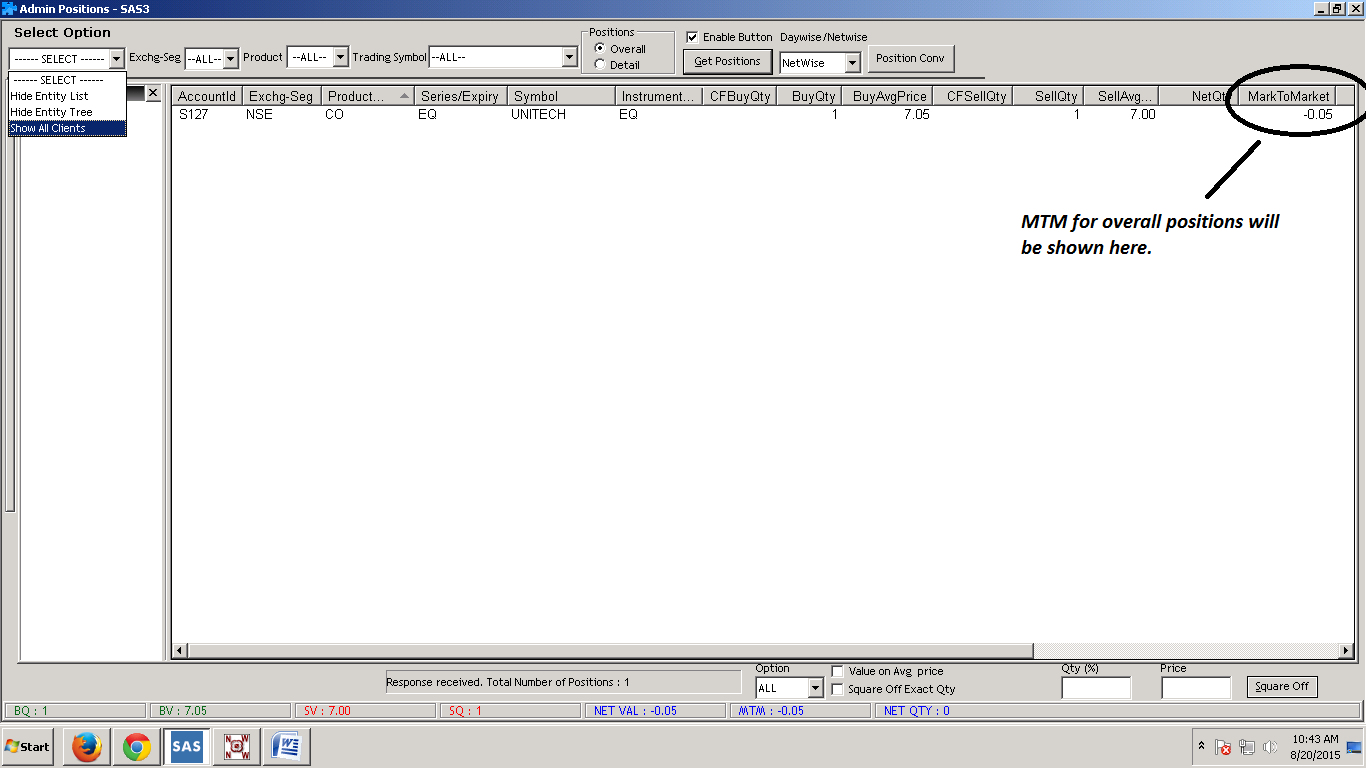

You can view overall profit & loss from the Admin position (F11). Select Netwise and click Get positions.

Simply fill the details, connect your bank account & upload your documents.

Open An AccountYou will be redirected in a few seconds.